As part of rolling changes to help the SA economy, the second stage of business/investment reforms has come through this financial year with commercial stamp duty being reduced to a third of the normal rate of duty. Come the start of the new financial year in 2018 this will become fully abolished – opening an interest property based opportunity in not having to fork out 10’s to 100’s of thousands of dollars in government charges.

How much are we talking?

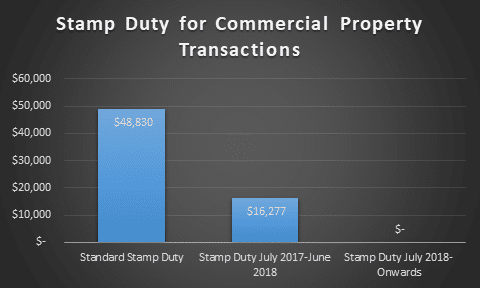

Let’s look at a $1,000,000 purchase in Adelaide currently. Based on a purchase at this level – this financial year the stamp duty changes results in a reduction of $32,553.33 in government charges. Here’s a little breakdown of the stamp duty comparison between the standard, rate, new discounted rate and the final abolished cost.

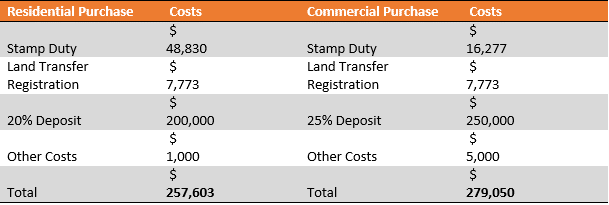

Whilst this isn’t only a considerable saving in costs for making an investment or business purchase – it also increases the viability of considering commercial property as an investment as it reduces what has been traditionally the biggest barrier to entering the commercial market – deposit costs. Let’s compare how a residential purchase vs commercial purchase now stacks up under the new reduced environment:

With the reduction the variance between the two is $21,447 and will close to $5,170 post July 2018.

This is a very interest time creating a strong incentive to consider commercial property – with the residential vs commercial deposit gap closing, whilst the ability to borrow in the commercial environment for investors remains strong even in the current APRA regulatory environment – so even those with nil borrowing capacity in the residential space can continue growing in the commercial asset class. For specific conveyancing advice, ensure you consult a local conveyancing specialist.

Looking to invest in commercial property? Get the right advice from the experts in lending for commercial property in Australia – click here to connect with us today

Leave A Comment

You must be logged in to post a comment.